Qatari Fintech: A Platform for Global Expansion

Despite its small size (with a population of just 2.7 million, the majority of whom are migrants), Qatar is one of the wealthiest countries in the world and has ambitions to become a global hub for financial technology (fintech)

In this regard, the domestic market in Qatar may not offer extensive opportunities for fintech companies to grow, but it can certainly serve as a platform for entering the regional market (including the Gulf countries, particularly the more attractive UAE and Saudi Arabia) and eventually the global market.

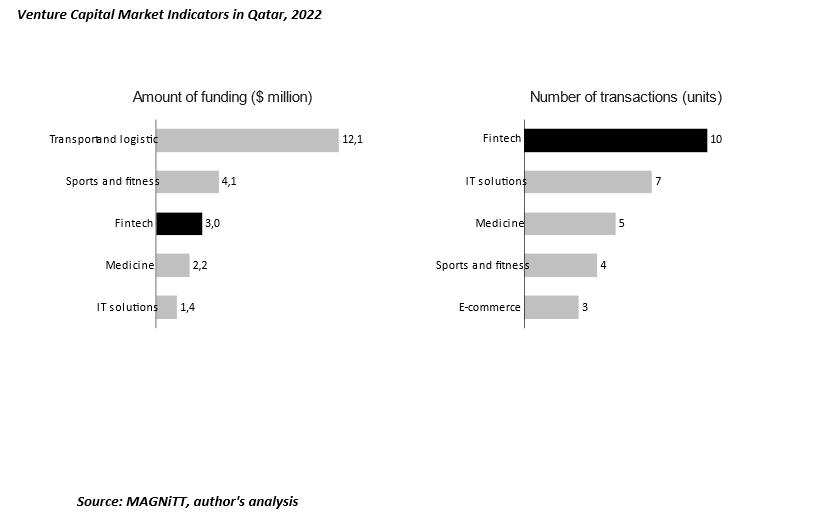

Looking at the venture capital market in Qatar, its size is on the verge of insignificance on a global scale, with rounds rarely exceeding $1 million, with few exceptions. However, fintech is the most active sector attracting financing. In terms of quantity, fintech deals outnumber those in IT, healthcare, and e-commerce.

Venture Capital Market Indicators in Qatar, 2022

Source: MAGNiTT, author’s analysis

On the other hand, the smaller scale of the market compared to the UAE and Saudi Arabia means less competition for financing. This fact can work in favor of foreign fintech companies that want to enter the MENA region or are unable to realize their potential in their home markets for various reasons.

In the Arab states of the Gulf, a development and support scheme for fintech has already been established. Qatar utilizes the same tools and mechanisms as the UAE and Saudi Arabia, including legislative improvements to simplify processes, the creation of regulatory sandboxes, direct financing, and the establishment of cooperative networks involving traditional players such as banks, big tech companies, and telecoms.

In March 2023, the Central Bank of Qatar announced its Fintech Development Strategy, which aims to increase the number of licensed fintech companies by 3-5 times (from 6 companies at the beginning of the year). The Qatar Financial Centre Regulatory Authority (QFCRA) has also formulated a fintech development strategy aimed at positioning Qatar as a leader. The key goals outlined in the strategy include:

- Facilitating fintech growth

- Stimulating collaboration between fintech companies and traditional financial institutions

- Attracting fintech talent from other countries

- Developing the fintech ecosystem through education and training programs..

In the past 10 years, the business climate for innovative projects in Qatar has significantly improved. Various acceleration programs and incubators have emerged, supporting the development of young companies in various sectors.

The main areas of focus in Qatar are mobile payments and wallets, driven by high demand for convenient and secure transactions, including international transfers from migrants residing in the country.

Among the fintech companies in Qatar, the following can be highlighted:

– CWallet (mobile wallet for transfers and personal finance management)

– iPay by Vodafone Qatar (mobile payment platform)

– Karty (personal finance management service)

– Dibsy (payment acceptance service for businesses)

– Spendwisor (mobile wallet with built-in retail loyalty programs)

– SkipCash (payment gateway)

– Fatora (payment acceptance and processing service for businesses)

The Qatar FinTech Hub (QFTH), under the supervision of the Qatar Development Bank (QDB), plays a key role in supporting fintech startups. QFTH is one of the largest investors in the venture capital market in the MENA region. The organization collaborates with other ecosystem participants, including the Central Bank of Qatar, the Qatar Financial Center (QFC), and Microsoft, who also provide support to fintech startups.

QFTH, in partnership with EY, implements three core support programs for fintech startups:

– Hackathon: Teams that successfully solve challenges have the opportunity to join the QFTH incubator or the fast-track program Visa FinTech.

– Incubator (12 weeks): Projects with a minimum viable product (MVP).

– Accelerator (12 weeks): Mature fintech companies aiming for global expansion with a proven product-market fit.

Startups participating in the incubation program have access to capital of up to 400,000 Qatari riyals ($110,000). Startups selected for the acceleration program can expect funding of 619,000 Qatari riyals (~$170,000).

Over 50 fintech startups have gone through the QFTH support programs, including more than 20 companies from the United States, India, Bangladesh, the United Kingdom, and other countries. The cumulative valuation of startups supported by QFTH exceeds 1.8 billion Qatari riyals (~$500 million).

In the summer of 2023, the 5th wave (since 2020) of project intake for the QFTH incubator and accelerator has already taken place. 21 projects from local and international startups in the payment technology sector (partner – Visa), insurance (partner – Qatar Insurance Group), BNPL services (partner – Mastercard), and crowdfunding (partner – QDB) were selected.

Qatar is also implementing the global initiative of Visa – Visa Everywhere Initiative – an open innovation program that allows startups to showcase their projects and technologies to key stakeholders in the financial, trade, venture, and government sectors.

The Qatari fintech ecosystem may not be the most developed in the world, and breakthrough startups with the potential to become unicorns may not emerge here. However, Qatar has advantages such as its geographical location (proximity to more attractive markets like the UAE and Saudi Arabia), access to venture capital, and the presence of global players (Visa, Mastercard, Microsoft) interested in collaborating with fintech companies. Therefore, Qatar may be of interest to fintech companies from developing countries seeking to enter new markets, obtain funding, and gain additional expertise and valuable contacts.

On the photo: Konstantin Tserazov, economist, former Senior Vice President of Otkritie Bank

Много сидишь в социальных сетях? Тогда читай полезные новости в группах "Qostanai.Media" ВКонтакте, в Одноклассниках, Фейсбуке и Инстаграме. Сообщить нам новость можно по номеру 8-701-031-72-31